The U.S. Supreme Court has officially struck down the Trump administration’s global tariffs, ruling that the executive branch exceeded its authority under the IEEPA.

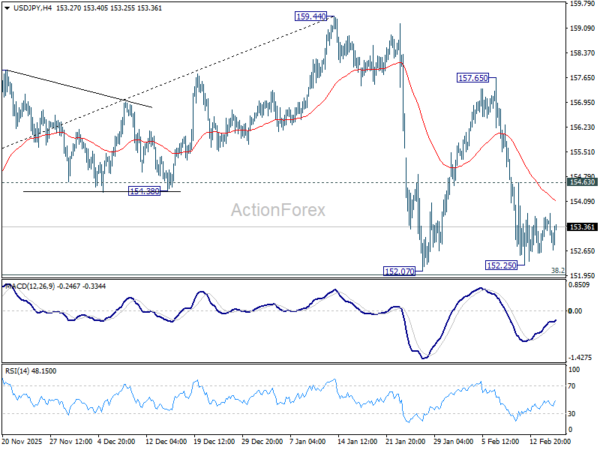

For now, the action remains very muted across FX, Stocks, and Crypto Markets, which are all close to unchanged on the session.

Only Metals are rallying, but that would mainly reflect weekend risk, if anything, and they actually faded their up-move on the Decision.

You can get access to the Full text of the Supreme Court decision right here.

Stocks spiked on the announcement, but the move isn’t looking like it will sustain, at least for now.

Overall, Markets are not reacting much for now because the Decision was largely priced in.

What could affect flows going forward is how the Trump Administration responds – they have been prepared for this issue, so what’s coming next is still uncharted territory.

Dow Jones 15M Chart – Source: TradingView. February 20, 2026

Safe Trades!