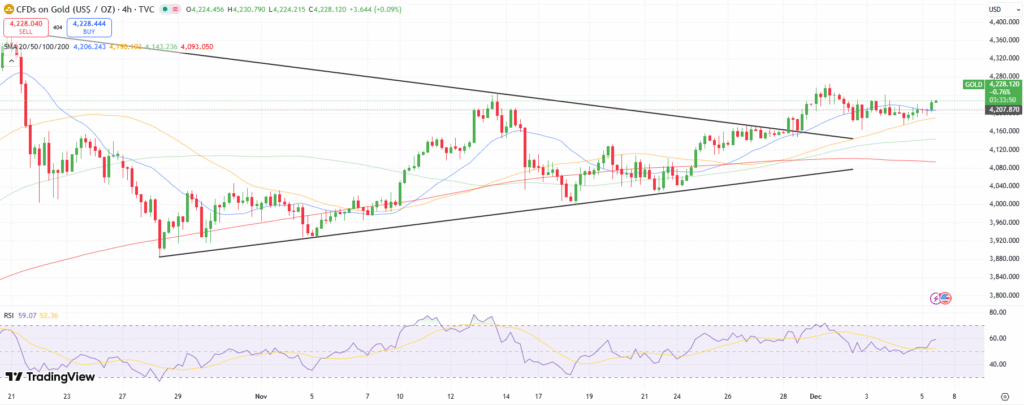

- Gold markets initially tried to rally during the trading session on Thursday, as we continue to see a lot of upward pressure in general.

- That being said, this is a market that has turned around quite violently, and there were a couple of major things that happened during the trading session on Thursday that has traders paying close attention to this market.

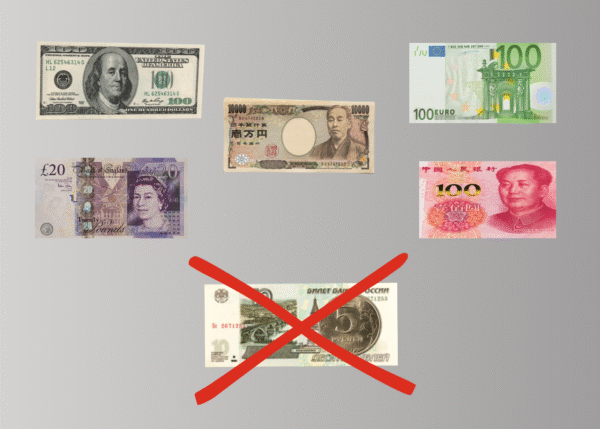

Remember, the gold market is considered to be a safety market, as you can protect your wealth by buying it. That has been the general moving gold as of late, as there are a lot of concerns about tariff wars, and of course whether or not central banks around the world will start cutting rates. There have been a couple of major problems over the last 24 hours, that seem to be working against the gold market, and that’s something that you need to pay close attention to.

Federal Reserve and Trade Deal

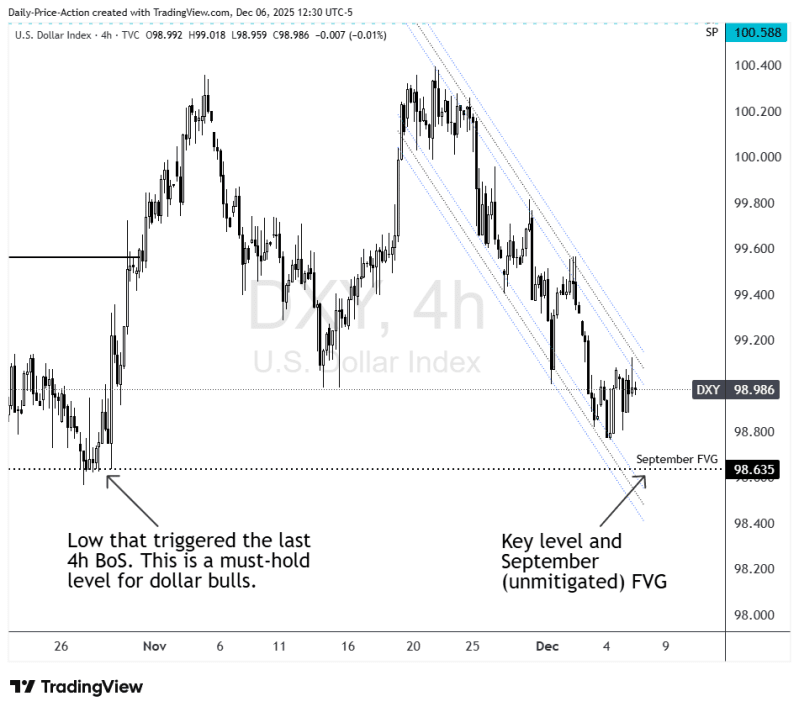

Keep in mind that the Federal Reserve doesn’t seem to know when it’s going to loosen monetary policy, something that would help gold over the longer term as it should weaken the US dollar. This helps the gold market in general, as it is priced in that same currency, although it doesn’t have to have that correlation. Because the Federal Reserve may stay tighter for longer, it means that the US dollar may strengthen.

Furthermore, the United States and the United Kingdom announced a major trade Deal during the early part of the Thursday session, and it got rid of some of the “risk off” behavior. Beyond that, Pres. Donald mentioned that it is possible that the Chinese may see some of the tariffs cut down as the 2 countries meet over the weekend. This has everybody going “risk on” on Wall Street, and that of course means that the “fear trade” when it comes to the gold market has been dealt a significant blow. This doesn’t mean that the trend is over, but it does mean that a pullback makes sense.

Ready to trade our Gold daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.