- The gold price remains in positive territory as dollar weakness prevails.

- Geopolitics and potential Fed easing continue to underpin the demand for gold.

- Markets await the US PCE inflation report for fresh trading opportunities.

The gold price held steady during the early European session on Friday, as the market tone remained cautious ahead of the delayed US September Core PCE inflation report. The data carries significant weight as it could shape the Fed policy outlook for the meeting next week. Despite the noise from geopolitical headlines, Treasury yields, and labor market data, gold remains in a familiar range above $4,200, lacking momentum to break above the key $4,250 area.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

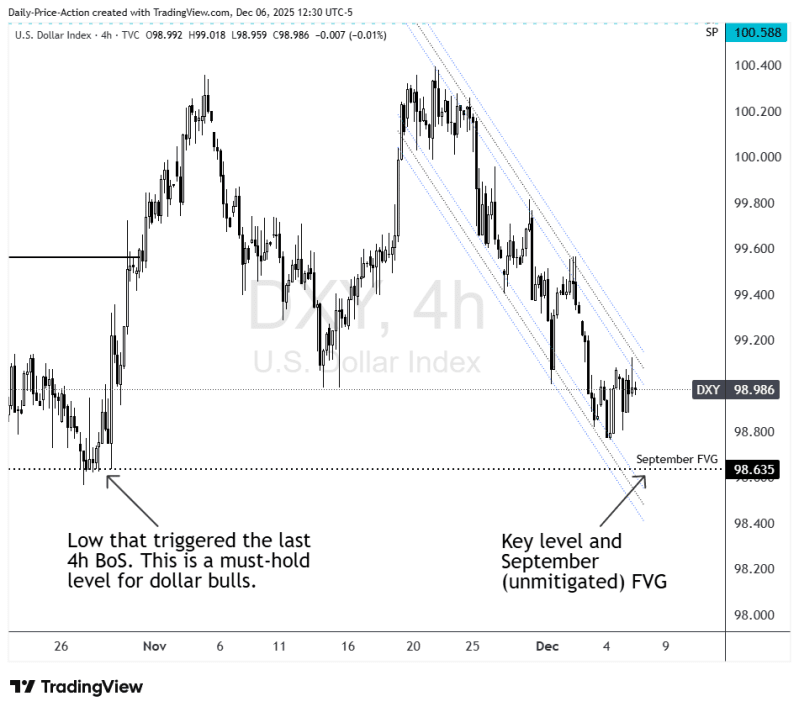

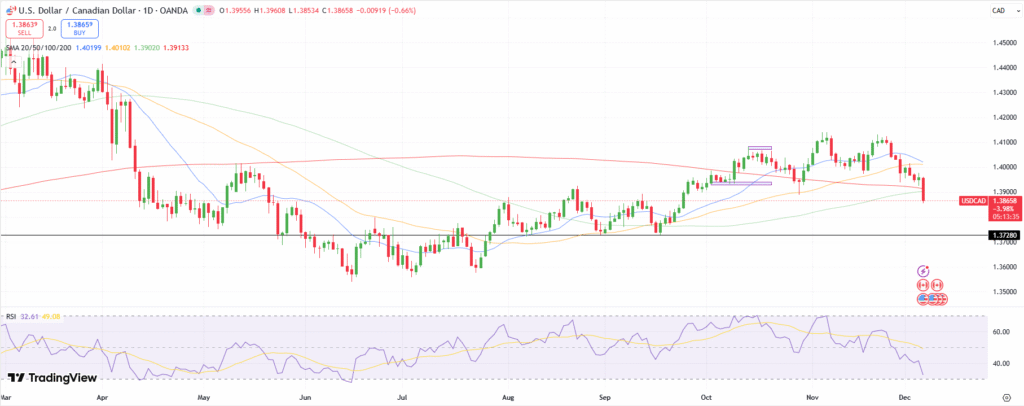

The Dollar Index (DXY) attempted to recover but remained unconvincing, as market expectations for a 25-bps rate cut now hover around 90%. Even the upbeat jobless claims data, which fell to 191k, the lowest level in three years, could not provide adequate support.

Treasury yields remain a key factor in gold’s momentum, especially after Japan’s bond market experienced instability, which lifted yields and capped bullish attempts in the bullion market. However, solid Japanese bond auctions on Thursday calmed the market nerves, offsetting upside yields that benefited the precious metal.

Geopolitics continues to provide a floor to gold pullbacks, with renewed concerns around the Russia-Ukraine conflict as the US peace proposal diminished after Ukraine’s drone strikes on Russian energy infrastructure. However, the fundamental picture remains mixed, making it difficult for gold to establish a directional bias as traders focus more on US inflation figures and the Fed’s reaction.

Zooming out, the outstanding performance of gold in 2025, with more than 50 record highs and 60% annual gains, defines the gold’s bullish trajectory as it heads into 2026. The World Gold Council attributes this rally to dollar weakness, geopolitical risks, and increased buying by central banks. A shallow economic slowdown could pose another surge of 5-15% for gold next year, while the doom loop could generate a 15-30% rise. Only a reflationary pressure and policy-driven boost to US growth could strengthen yields and weigh on gold.

Gold Key Events to Watch

The two major events for the day include:

- US PCE Price Index

- UoM Consumer Sentiment

Any downward revision could push the gold for a significant rally towards last week’s highs of $4,260.

Gold Technical Price Analysis: Positive Above 20-MA

The recent 4-hour candle has surged above the 20-period MA, aiming to test the immediate resistance at $4,240 ahead of a potential swing high near $4,265. The RSI is also in the positive zone, heading north, revealing adequate room for gold gains.

–Are you interested to learn more about crypto signals? Check our detailed guide-

Conversely, failing to hold at current levels could aim to test the confluence area of the round figure and 20-period MA around $4,200-10. Below this support, the next key level emerges at $4,175 ahead of a swing low near $4,160.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.