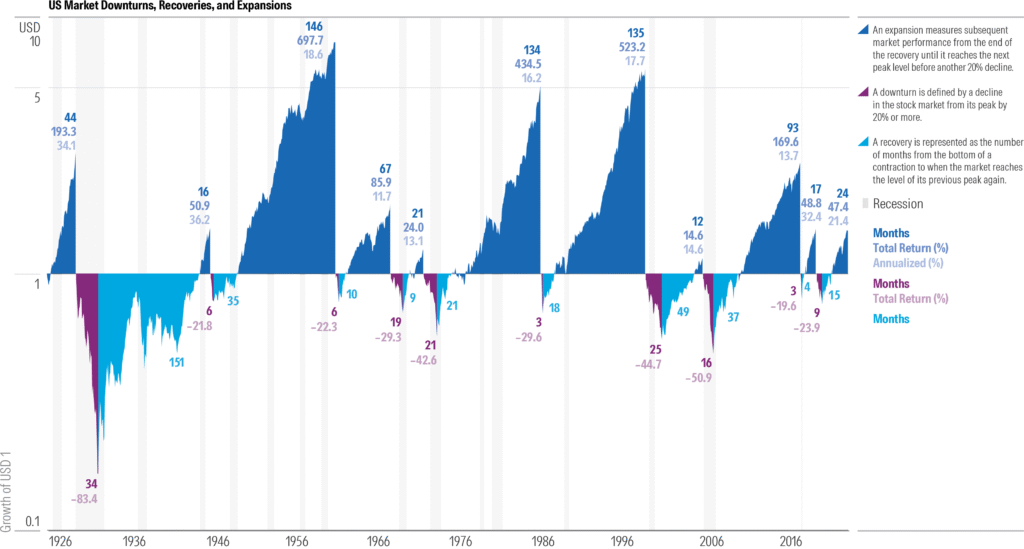

After a year of new records on the stock market, 2025 is expected to bring more rallies. But what are the key factors that could move market sentiment in the new year?

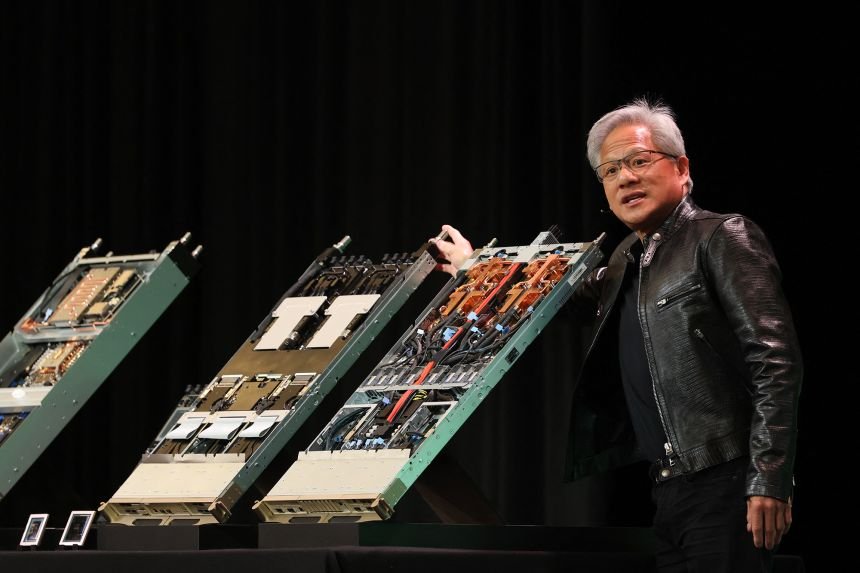

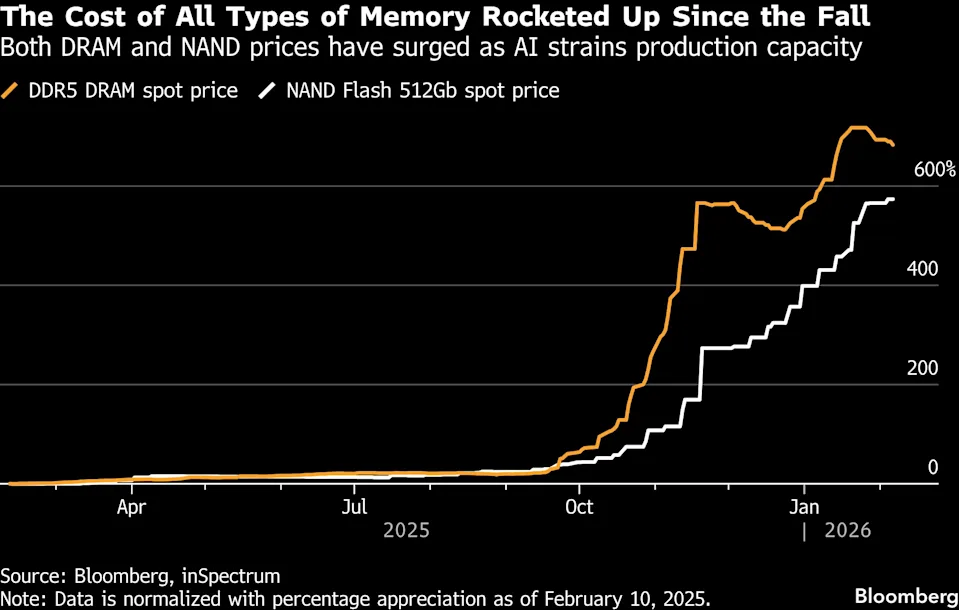

Global equities reached record highs in 2024, mainly due to generative artificial intelligence and the global economic recovery.

Building on the positive economic backdrop in 2024, the global economy is expected to keep growing and stocks are expected to keep riding the wave in the new year, according to analysts.

Is the stock market euphoria going to last in 2025?

UK-based investment management company Brooks Macdonald states that easing inflation pressures and decreasing interest rates are expected to drive market performance.

In the US, markets could also be fuelled by “extension (and possible enhancement) of tax cuts in 2025”, said Chris Crawford, managing partner at Crawford Fund Management.

Another wealth manager, AJ Bell, also foresees good results on the stock markets, especially in “Big Tech”, if investors choose “the right approach”.

AJ Bell investment director Russ Mould warned that the rules of the market are changing, thanks to AI, and said that “investors need to consider the words of American industrialist J. Paul Getty, who once asserted that ‘in times of rapid change, experience can be your worst enemy’, because those who are sticking to long-held valuation disciplines are getting left behind as US equities generally, AI-related names more specifically and cryptocurrencies are all on a roll.”

Mould said he expects this trend to continue as long as the cooler inflation, steady growth and lower interest rates develop as hoped.

Chris Crawford added that Bitcoin’s recent rally is not over. “The increasing mainstream adoption of Bitcoin is another interesting narrative that we expect in the new year as financial advisors and institutions integrate Bitcoin into their portfolios.”

However, he noted that markets need to be aware of the risks, including debt, tariffs and a stronger dollar, which could weigh on trade and growth.

What are the five things that could shape the market?

1 . Sovereign debt

Analysts agree that major economies are grappling with a mounting debt problem that could endanger economic growth. “Addressing these challenges will be crucial for maintaining economic stability in 2025”, Brooks Macdonald said in their outlook for 2025.

In the UK and France, the debt-to-GDP ratio is almost 100% and 112% respectively. On the other side of the pond, the US is facing 123% and with expectations of it rising further. “President-elect Trump’s policy package could even accelerate growth in government borrowing from what is already a record-high of $36tn (€34.3trn)”, Mould said, adding that the US’s annualised interest bill on that debt already exceeds $1tn, “a sum larger than the defence budget”.

Unless the US starts cutting expenses or raising income, there could be trouble ahead. The possible scenarios include “either bond yields rise in the face of growing supply, or interest rates stay higher for longer, or the Fed looks to cut rates”, Mould said, adding that “this final scenario may be why gold (and bitcoin, for that matter) are on a roll, as investors seek perceived stores of value”.

2. World trade developments

While US economic growth is expected to impress, President-Elect Donald Trump’s trade policy, including tariffs, may push China and the eurozone, especially Germany, back behind other regions. Tariffs would also fuel inflation in the US, potentially leading the Fed to alter its monetary policy.

However, analysts are optimistic.

“The possibility of a major trade war may prove to be overstated, as the implementation of tariffs by the Trump administration is expected to remain targeted and limited”, Crawford said.

“Trump talked loudly and carried a big stick on the subject of tariffs during his first term, but he only really wielded the stick at China”, Mould said. “We may see the same again this time around given Trump’s propensity to seek a deal.”

Potential global trade tensions between the US and China could bring about disruption to global supply chains, noted Brooks Macdonald’s outlook.

3. Watch the dollar

US tariffs could lower the US trade deficit and that would result in fewer dollars leaving the country. According to AJ Bell: “If they produce America’s first trade surplus since 1975, dollars will actively flow back into the US.” Due to the dollar’s status as the world’s reserve currency, used across the global economy and financial markets, having less of them could lead to “global liquidity drying up, with potentially deleterious consequences”, Mould highlighted.

Having fewer dollars, so essentially a strong US currency, would also increase the debt servicing cost of emerging countries that often borrow in this currency.

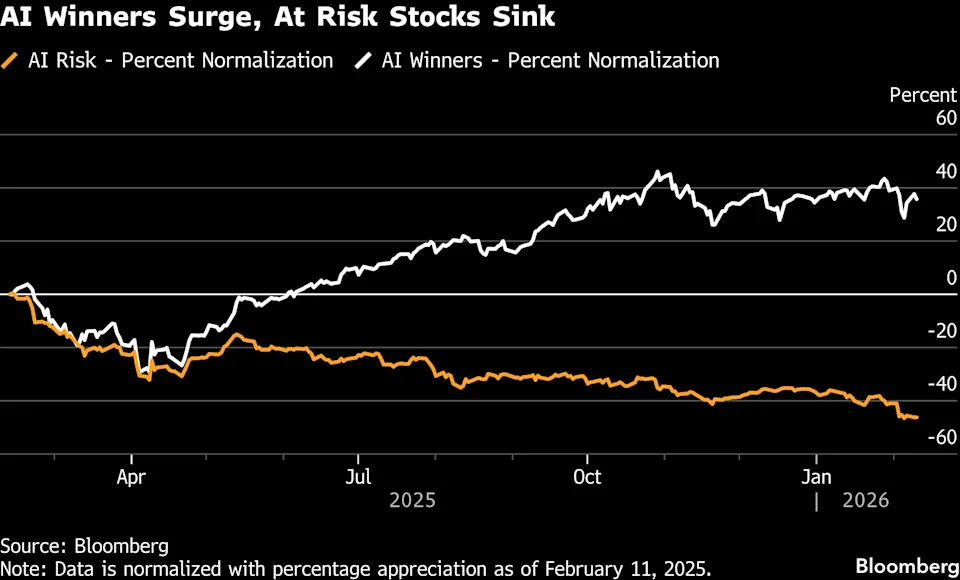

4. Are the Magnificent Seven going to keep the ‘magic’?

In the stock market, the so-called Magnificent Seven made up of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla have made a lot of money this year. However, they may not be fuelled by the same level of enthusiasm in the new year as in 2024.

“This year’s average 65% gain across the septet leaves them with an aggregate market capitalisation of $18tn, or 35% of the S&P 500,” Mould said, adding that an unexpected recession could pose a challenge for these companies, as well as sustained inflation and higher than expected rates. “Only a perfect middle path may do to justify their lofty valuations,” Mould added.

Crawford believes that: “The dominance of the Magnificent 7 is expected to fade as embedded extreme expectations, and the sheer size of these companies, constrain performance.”

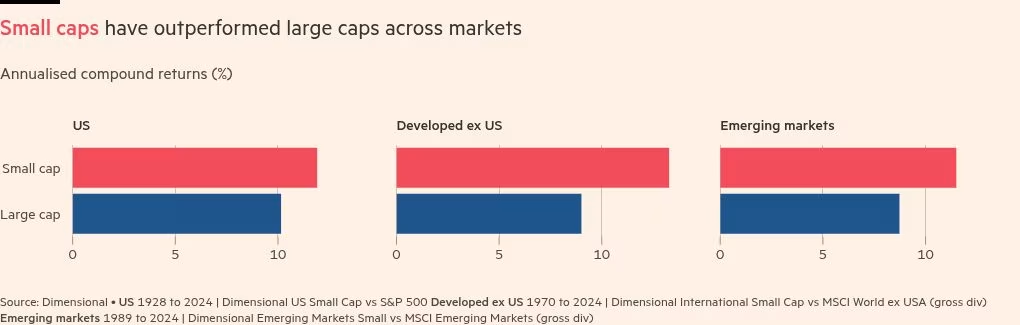

He believes: “Small and mid-cap equities, which have fallen behind in the last few years, should grow and attract more attention from investors.”

5. Mergers and acquisitions are on the horizon in 2025

“The new year will usher in an M&A boom, sparked by the relaxing of government regulations and willing credit markets”, Crawford also noted – and he predicts that: “This will be the most significant deal wave in over a decade, creating opportunities for investors positioned in sectors that are ready for consolidation.”

IPOs may also sweep the floor, according to the Crawford Fund Management.

“Conditions are favourable for the new issues market to reopen after a long drought and expect a wave of IPOs to hit the equity market in 2025 and to be well received with potentially generous valuations.”

Disclaimer: This information does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances. Also remember, we are a journalistic website and aim to provide the best guides, tips and advice from experts. If you rely on the information on this page, then you do so entirely at your own risk.