- The EUR/USD outlook remains mildly supported amid a weaker dollar.

- The Dollar Index remains steady after losses as the US yields rise on Tuesday.

- Markets anticipate the US ADP and IS Services PMI data due this week.

The EUR/USD price remains flat near 1.1610 on Tuesday’s European session, after reaching a 2-week top near 1.1650 on Monday. The pair lost some upward traction as the US dollar attempted a modest recovery amid rising US Treasury yields and lingering caution across global markets. Traders are now awaiting Eurozone HICP inflation, and the unemployment rate.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The US Dollar Index (DXY) remains steady above 99.00, recovering from Monday’s lows despite disappointing US ISM PMI data. The figures came at 48.2, marking a ninth consecutive month of contraction, with new orders and employment sliding while price pressure surged. Usually, such data weighs on the dollar, but Monday’s surge in US yields, triggered by a global bond sell-off, offered temporary relief to the greenback.

The catalyst behind the sell-off was Bank of Japan Governor Ueda, who signaled a potential rate hike in December, sending JGB yields higher, igniting volatility in global bond markets. A well-received JGB auction earlier on Tuesday calmed the markets, but cautiousness remains.

Geopolitics also remains a key factor in euro sentiment. OCBC and ING analysts highlight that the progress in the Russia-Ukraine peace talks remains underpriced in the euro. Any tangible progress could suppress the dollar’s safe-haven demand, lifting the EUR/USD to 1.1700.

The policy expectations from the Fed continue to price 87% odds of a 25 bps rate cut by the Fed. Moreover, Kevin Hassett, as a potential successor to Fed Chair Powell, also poses a downside risk for the dollar as the candidate is considered aligned with Trump’s low-rate preference.

The near-term drivers will be Wednesday’s ADP Employment Change and ISM Services PMI. A softer labour print or weaker services activity could pressure the dollar again, potentially enabling EUR/USD to retest last week’s highs. Conversely, any upside surprise could stall the rally temporarily.

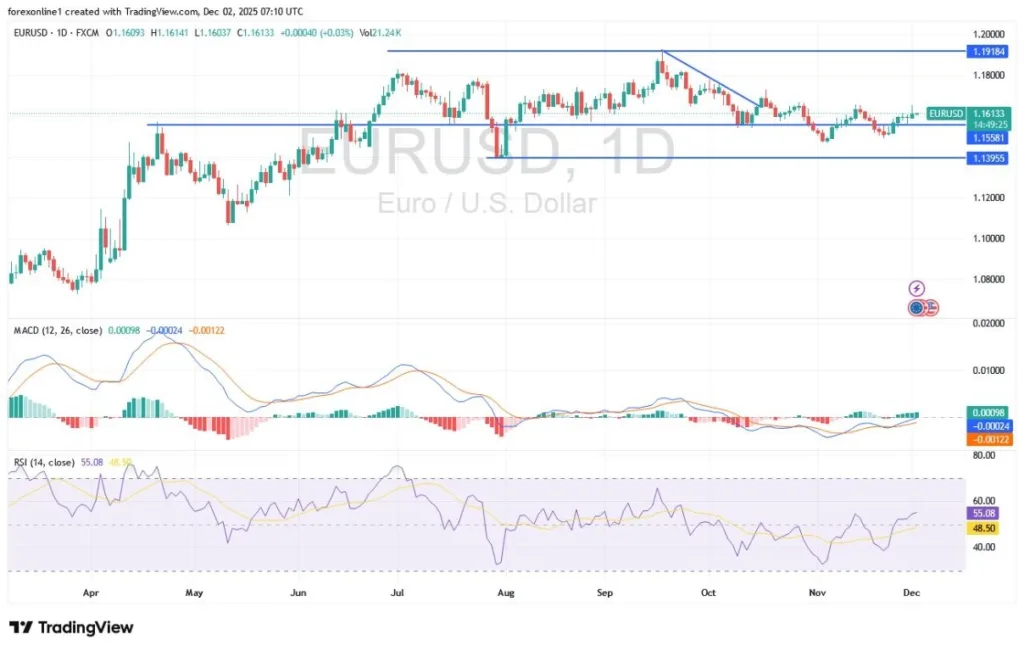

EUR/USD Technical Outlook: Choppy Near 20-MA

The EUR/USD 4-hour chart shows a solid support near the round number and 20-period MA confluence at 1.1600. However, the MA arrangement doesn’t align with the bullish bias, suggesting a potential consolidation. The RSI also remains flat above 50.0, adding confirmation to the choppy behavior.

–Are you interested to learn more about crypto signals? Check our detailed guide-

Sustaining above the 1.1600 mark could gather buying traction and look to test November’s top near 1.1650 ahead of 1.1720. Conversely, breaking below the 1.1600 could aim to test 1.1550 ahead of 1.1500.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.