It’s that time of year when business tycoons and influential world leaders gather in Davos, Switzerland for the annual meeting of the World Economic Forum . Speakers at this week’s retreat, who are addressing a plethora of global issues, included Chinese Vice Premier Ding Xuexiang on Tuesday and European Central Bank President Christine Lagard on Wednesday. President Donald Trump is set to speak via remote on Thursday. Larry Fink, CEO of Club name BlackRock is scheduled as part of an economic panel on Friday. Among the list of nearly 3,000 attendees are the chief executives of four other Club holdings: two of our newer positions CrowdStrike and Goldman Sachs and two portfolio veterans Microsoft and Salesforce . During a series of interviews with CNBC from Davos, the execs discussed everything from cybersecurity to generative artificial intelligence adoption to the implications of another four years of Trump in the White House. CrowdStrike On Tuesday, CrowdStrike CEO George Kurtz discussed how the cybersecurity industry is changing as more and more companies integrate AI. Demand for cyber solutions will rise as businesses become more vulnerable to breaches, given how much data goes into AI models. Most notably, Kurtz also addressed the global IT meltdown that CrowdStrike’s buggy software update caused in July. “We’ve documented those issues that we found. We’ve corrected those. And again, we had the conversation with customers. Broken bones heal stronger.” Kurtz said. “[Customers] know that’s not going to happen again.” Since the post-outage lows around $201 per share on Aug. 5, CrowdStrike stock, as of Wednesday afternoon, was trading up 88% to $377. The Club initiated a position on Oct. 16 at around $308 per share. In the cybersecurity sector, we own peer Palo Alto Networks as well, which also had a strong week . Goldman Sachs Goldman Sachs CEO David Solomon told CNBC on Wednesday that more Wall Street dealmaking was on the horizon in 2025 under the new Trump administration. That’s because prospective investment banking clients (IB) are expected to face fewer hurdles in pursuit of mergers and acquisitions and other types of deals. “There’s no question that the private equity and venture capital community has been on the sidelines for the last couple of years,” Solomon said. “From what we see from inside the organization, the activity levels [and] the lineup of things people want to bring to market should allow us to see a meaningful increase of pace in deal activity in 2025.” The CEO added, “We’re coming off a very, very tough regulatory environment across all industries. … The change in that is something that could be quite constructive. But it’s going to take time.” The Club initiated a position on Dec. 16 at nearly $561 per share — seeing Goldman as a better way to play the expected rebound in IB than Morgan Stanley , which we later exited. Goldman, as of Wednesday afternoon trading, has gained 12% since we began buying shares. Microsoft Satya Nadella, CEO of longtime Club holding Microsoft, talked Wednesday about how AI could impact the corporate workforce. While some worry about how the technology could lead to job losses , Nadella said that AI actually enables companies to restructure and redefine the roles they do instead. Microsoft has bet big on the future of generative AI. Not only has the company rolled out offerings such as its virtual AI assistant, Copilot, but management said recently they would invest $80 billion in AI-enabled data centers in fiscal year 2025 alone. “There’s going to be productivity increases because in some sense AI does really help reduce the drudgery in a lot of our work,” Nadella said. “What AI does quite frankly is simultaneously reduce the floor and raise the ceiling for all of us. So, that means [as] the expertise level inside of an organization goes up, productivity goes up [too].” Salesforce Salesforce CEO Marc Benioff touted the success of Agentforce , the company’s new suite of AI automation tools. Because of Agentforce, Benioff said Wednesday that 2025 is the first year in company history that it won’t hire any net new software engineers. “It’s not because I’m not going to write a huge amount of new products. It’s because our software engineers are incredibly productive. They are by 30% to 50% more productive than they were 18 months ago.” He added, “So this technology, the agent technology, again, is making our engineers more productive. Our support engineers [are] more productive. [Our] salespeople are more productive, [and] our marketers are more productive.” Like Microsoft, Salesforce has also been a longtime Club name. (Jim Cramer’s Charitable Trust is long CRWD, GS, CRM, MSFT, BLK. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

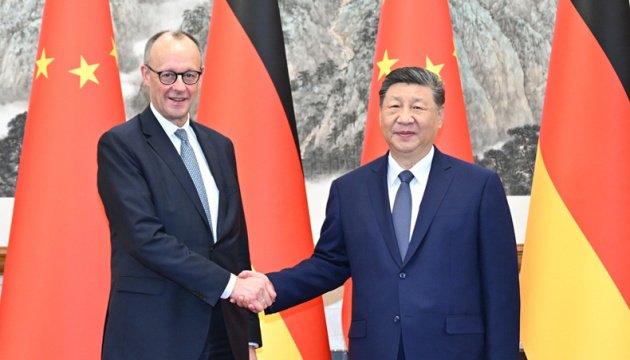

Swiss police patrol outside the Congress Center ahead of the World Economic Forum in Davos, Switzerland, on Jan. 19, 2025.

Yves Herman | Reuters

It’s that time of year when business tycoons and influential world leaders gather in Davos, Switzerland for the annual meeting of the World Economic Forum.

Visited 1 times, 1 visit(s) today