- USD/JPY outlook remains weak as the dollar tumbles after weaker ADP data.

- The increasing odds of BoJ rate hikes provide moderate support to the yen.

- Rising JGB yields and FX intervention warnings weigh on the USD/JPY.

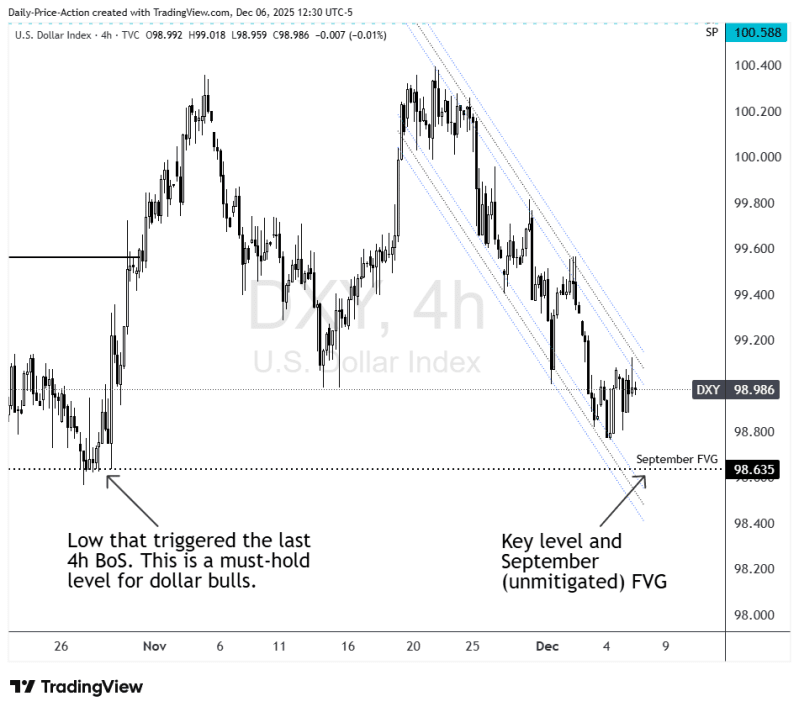

The USD/JPY price is attempting to stabilize on Thursday after a sharp fall in the previous session. The pair is trading near 154.90 at the time of writing. Japanese yen found moderate support from the Bank of Japan’s rate hike. The Dollar Index (DXY) briefly broke below the 99.00 level on Wednesday after disappointing U.S. data intensified bets on a Fed rate cut. Earlier on Thursday, the Dollar Index recovered mildly, but the upside remains capped as the markets digest recent labor market and services sector data.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Wednesday’s US ADP report showed the private sector jobs declined by 32,000 in November, well below expectations, marking a sharp contraction since early 2023. The ISM Services PMI slightly increased to 52.6; however, the Employment Index fell to 48.9, reinforcing the narrative of a cooling labor market. This macroeconomic backdrop has increased the probability of a rate cut to 90%, allowing the yen to recover against the US dollar.

On the Japanese front, the sentiment is leaning towards a December rate hike by the Bank of Japan. According to Reuters, policymakers and government officials are prepared for a 25-basis-point hike to 0.75% at the December 19 meeting, potentially the first hike since January. Governor Ueda said the BoJ will consider the pros and cons of raising rates and noted that the real rates will remain negative even with another hike. A sustained upward trend in the S&P Global Composite PMI to 52.0 in November supports the odds of an increase in the benchmark rate.

Moreover, Japan’s Prime Minister Sanae Takaichi’s fiscal stimulus, backed by additional debt, is lifting JGB yields, narrowing the US-Japan yield gap. Meanwhile, Fed officials have already warned of potential FX intervention in the event of excessive yen weakness.

USD/JPY Key Events Ahead:

Markets will now look closely at Initial Jobless Claims later today and the PCE inflation data on Friday for confirmation of the Fed’s easing path.

USD/JPY Technical Outlook: Bears Eyeing 200-MA

The USD/JPY outlook remains technically weak near the key support at 154.80, with a breakout eying the 200-period MA near 154.40. Further downside could aim to test November 14 swing lows at 153.60.

–Are you interested to learn more about crypto signals? Check our detailed guide-

However, the RSI is near the oversold region, which could provide an interim bounce back. The price could see a mild upside to the 20-period MA near 155.50 ahead of 156.00.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.