Bearish view

- Sell the GBP/USD pair and set a take-profit at 1.3015.

- Add a stop-loss at 1.3350.

- Timeline: 1-2 days.

Bullish view

- Buy the GBP/USD pair and set a take-profit at 1.3350.

- Add a stop-loss at 1.3015.

The GBP/USD exchange rate held steady on Monday morning as investors continued to reflect on last week’s budget speech by Rachel Reeves, the Chancellor of the Exchequer. It was trading at 1.3230, higher than the November low of 1.3011.

Focus Remains on Rachel Reeves’ Budget

The GBP/USD exchange rate has rebounded in the past few days as a sense of calm spread in the financial market after the autumn budget read last Thursday.

In it, Reeves decided to raise taxes on businesses and individuals, a move she expects will help to reduce the deficit and create an emergency buffer.

For example, she raised taxes on sports betting companies, a move that will cost a company like Flutter Entertainment over £500 million a year. She also launched a mansion tax that will collect a levy on houses valued at over £2 billion.

The market reacted positively to the budget, with the sterling and FTSE 100 Index rising and bond yields moving downwards sharply.

Looking ahead, the GBP/USD exchange rate pair will react to the upcoming UK and US manufacturing and services PMI numbers, which will show whether economies are recovering.

Another important data will come from Nationwide and Halifax, which will publish that latest house price index data, which will provide more color on the state of the housing sector.

Meanwhile, the GBP/USD exchange rate will react to some notable data from the United States, some of which may have an impact on the Federal Reserve interest rate decision. For example, the US will publish the latest personal consumption index (PCE) data, which is the Federal Reserve’s most important inflation gauge.

GBP/USD Technical Analysis

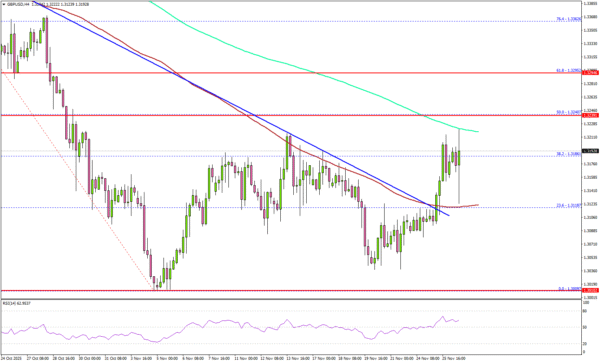

The GBP/USD pair has dropped sharply from the year-to-date high of 1.3805 to the current 1.3230.

This drop has pushed it below the 50-day Exponential Moving Average (EMA), while the Supertrend indicator has turned red, which is considered a highly bearish sign.

The pair has formed a bearish flag pattern, which is made up of a vertical line and horizontal channel. This pattern often leads to more downside

It is hovering at the 38.2% Fibonacci Retracement level. Therefore, the most likely GBP/USD pair forecast is bearish, with the next key target level being at 1.3010, its lowest level last month. The bearish forecast will become invalid if the Supertrend turns green.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best UK forex brokers in the industry for you.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.